BTC Price Prediction: Analyzing Trends and Market Sentiment for 2025-2040

#BTC

- Technical Indicators: BTC is testing key support levels amid bearish signals.

- Market Sentiment: Panic selling contrasts with long-term institutional confidence.

- Price Forecasts: Bullish long-term outlook driven by adoption and scarcity.

BTC Price Prediction

BTC Technical Analysis: Key Indicators and Future Trends

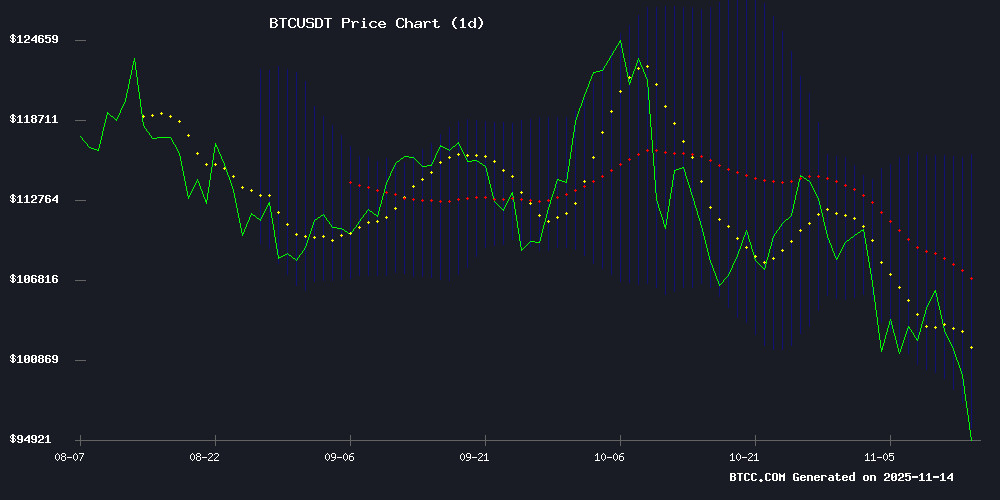

According to BTCC financial analyst Sophia, Bitcoin's current price of $94,982.38 is below its 20-day moving average (MA) of $105,962.09, indicating a potential bearish trend in the short term. The MACD (12,26,9) shows a positive histogram at 1,465.2069, suggesting some bullish momentum remains. Bollinger Bands reveal the price is NEAR the lower band at $95,800.21, which could act as a support level. If BTC holds above this level, a rebound toward the middle band at $105,962.09 is possible. However, a break below may lead to further declines.

Market Sentiment: Bitcoin's Volatility and Institutional Moves

BTCC financial analyst Sophia notes that Bitcoin's drop below $100K has triggered market panic, as seen in recent news headlines. Massive liquidations and sharp corrections highlight the fragility of the crypto market. However, institutional interest remains strong, with Grayscale maintaining dominance and the Czech National Bank making a historic $1M crypto purchase. Michael Saylor's bullish prediction that Bitcoin will surpass gold's market cap by 2035 contrasts with current sentiment, where gold is rallying while BTC consolidates near $100K. Regulatory scrutiny, such as Japan's potential stricter rules, adds to the uncertainty.

Factors Influencing BTC’s Price

Bitcoin Plunges Below $100K, Tests $95K Support Amid Massive Liquidations

Bitcoin's dramatic descent below the psychological $100,000 mark has sent shockwaves through crypto markets. The flagship cryptocurrency tumbled to $98,550 in a violent liquidation cascade, erasing $655 million from leveraged longs within 24 hours. Coinbase data reveals the sell-off accelerated after spot ETFs recorded $278 million in net outflows on November 12.

The breakdown exposes Bitcoin's fragile market structure beneath six figures. On-chain analysis shows 65% of all invested USD now sits above $95,000 - a critical support level where long-term holders begin accumulating. This HODL wall represents the last line of defense before potentially deeper declines.

TradingView charts capture the severity of the move, with Bitcoin peaking at $103,988 before collapsing to $95,900. The 5% cushion above the $95k support has nearly evaporated, leaving bulls with dwindling protection. Market dynamics suggest this isn't speculative froth being cleared, but a fundamental test of investor conviction at record price levels.

Grayscale Files for IPO Amid Revenue Decline, Maintains Crypto Dominance

Grayscale Investments, the powerhouse behind the Grayscale Bitcoin Trust (GBTC), has officially filed for an initial public offering. The move comes despite a 20% revenue drop to $318.7 million in the first nine months of 2025, with net profits sliding to $203.3 million. Yet, the firm continues to command $35 billion in crypto assets—a testament to its market leadership.

The IPO employs an Up-C structure, a favored model in tech finance, with shares reserved for loyal investors through a special program targeting historic crypto participants. This strategic play follows the SEC's reopening after a 43-day shutdown, positioning Grayscale to capitalize on renewed regulatory momentum.

While the financials show strain, Grayscale's IPO underscores its ambition to transcend traditional crypto offerings. The firm's centralized control model and institutional approach set it apart from typical token launches, reinforcing its role as a bridge between digital assets and mainstream finance.

Bitcoin Plunge Triggers Market Panic as Crypto Sector Faces Sharp Correction

Bitcoin tumbled below $98,000, erasing $700 million in long positions and sparking a broader crypto selloff. The drop marks Bitcoin's third major correction this November, with altcoins following suit as fear grips the market.

U.S. financial pressures and a tech stock rout exacerbated the decline. Crypto-linked stocks cratered—Cipher Mining plunged 14.4%, while Coinbase and MicroStrategy lost 7%. The S&P 500 and Nasdaq fell 1.3% and 2%, respectively, dragging risk assets lower.

Miners faced brutal liquidations, with Bitdeer and Bitfarms dropping 19% and 13%. Yet Bitcoin Hyper's $HYPER presale defied the trend, crossing $27.5 million in fundraising as traders sought hedges against volatility.

Czech National Bank Makes Historic $1M Crypto Purchase in Pilot Program

The Czech National Bank has quietly executed a landmark transaction, acquiring $1 million in cryptocurrency assets as part of an experimental program. This marks the first known instance of a European central bank directly purchasing digital assets, with Bitcoin comprising a portion of the test portfolio.

Rather than signaling imminent adoption, the move represents a cautious exploration of blockchain-based financial instruments. The CNB's experimental holdings include three asset classes: Bitcoin, a dollar-pegged stablecoin, and tokenized bank deposits—a strategic selection demonstrating both speculative and practical applications of distributed ledger technology.

Conducted under the bank's CNB Lab innovation initiative, this pilot reflects growing institutional curiosity about crypto's role in future monetary systems. The modest investment size underscores the exploratory nature of the program while establishing an important precedent for central bank engagement with digital assets.

Bitcoin Breaches $100,000 Threshold Amid Market Turbulence

Bitcoin's sharp decline below the psychologically significant $100,000 mark has sent ripples through cryptocurrency markets. The digital asset tumbled over 4% within hours, erasing critical support levels and triggering widespread liquidations.

Technical indicators paint a bearish picture. BTC now trades below its 100-hour moving average, with a pronounced resistance forming near $102,200. Market sentiment soured decisively after failed attempts to sustain momentum above $103,500 - a key pivot point separating bullish and bearish territory.

The MACD's acceleration in negative territory and RSI's plunge below 50 suggest deepening downward pressure. Long-term holders appear to be capitulating, exacerbating selling pressure in what may evolve from technical correction to sustained downtrend.

Michael Saylor Predicts Bitcoin Will Outshine Gold’s Market Cap by 2035

MicroStrategy's Michael Saylor has projected that Bitcoin will eclipse gold's market capitalization by 2035, leveraging its digital scarcity and finite supply as key advantages. With 99% of BTC expected to be mined by that year, Saylor urges investors to position themselves before the final 1% enters circulation over the next century.

Bitcoin's current correction phase sees it trading near $99,254, testing critical weekly support levels. While short-term indicators suggest bearish pressure, a decisive rebound above $105,000 could reignite bullish momentum.

The crypto community is debating Saylor's forecast, with proponents highlighting Bitcoin's programmability, borderless transferability, and decentralized architecture as superior to gold's physical limitations. Market observers note the prediction aligns with growing institutional recognition of BTC as a next-generation store of value.

Bitcoin Sentiment Crashes While Gold Rallies

Crypto markets are buckling under extreme fear, with investor sentiment plunging to levels not seen since March. The Crypto Fear & Greed Index has collapsed to 15/100—a stark indicator of retail capitulation. Technical signals now suggest a potential breaking point, as social engagement around Bitcoin evaporates.

Gold’s resurgence contrasts sharply with digital assets’ struggles. Analysts from BitQuant and Santiment observe textbook capitulation patterns, hinting at an imminent reversal. Yet the market remains trapped in a cycle of distrust, where fear overrides fundamentals.

The timing raises uncomfortable questions. While traditional markets celebrate Washington’s budget resolution, crypto’s decoupling grows more pronounced. This isn’t mere volatility—it’s a stress test for the ecosystem’s resilience.

Bitcoin Consolidates Near $100K Amid Seller Exhaustion and Weak Institutional Flows

Bitcoin hovers above $100,000, caught between resistance at $106,000 and support at the psychological threshold. The market shows signs of fatigue, with ETF outflows and tepid derivatives activity reflecting widespread caution. Yet beneath the surface, seller exhaustion near the $100,000 level suggests a potential short-term rebound.

Glassnode data reveals a liquidity drought and wavering conviction since early October, when Bitcoin dipped below the short-term holder cost basis of $111,900. The current price action mirrors historic consolidation patterns—June-October 2024 and February-April 2025—where compression preceded decisive moves. Until Bitcoin reclaims $111,900 as support, retesting the $97,000-$100,000 zone remains probable.

The $100,000 battleground has witnessed dramatic capitulation, with over 80% of recent sells occurring at a loss during the dip to $98,000. This pain point now shows early stabilization signals as selling pressure abates.

Japan Exchange Group Considers Stricter Crypto Regulations Amid Market Volatility

Japan Exchange Group (JPX) is evaluating tighter oversight for companies transitioning to cryptocurrency as their primary business. The move follows a 75% plunge in Metaplanet's stock—despite its substantial Bitcoin holdings—highlighting governance risks in digital-asset treasuries.

Regulators may treat such pivots as de facto new listings, requiring fresh approvals and audits. At least three firms have already been advised to scale back crypto acquisition plans, with JPX warning of potential fundraising constraints.

Japan's approach contrasts with Hong Kong and Australia, having approved 14 Bitcoin firms for listing. The debate reflects growing institutional caution as volatile crypto holdings destabilize traditional market valuations.

Will the End of the Shutdown Really Boost the Crypto Market?

The resumption of U.S. government operations has reignited regulatory momentum, with the SEC and CFTC poised to advance crypto ETFs and establish clearer market frameworks. Yet Bitcoin ETFs continue to see tepid inflows, and institutional investors remain wary amid macroeconomic headwinds.

While the shutdown's end removes a critical uncertainty, it has not catalyzed immediate bullish momentum. The market now looks toward macro conditions and monetary policy shifts as potential triggers for the next upward cycle.

Bitcoin Volatility Highlights Fragility of Fiat Markets Amid ETF Outflows

Bitcoin's price plunged below $100,000 this week, defying expectations of a rally after the U.S. government reopened. The sell-off accelerated as traders liquidated $140 million in long positions within an hour, while Bitcoin ETFs saw heavy outflows. Market sentiment has turned cautious as fading hopes for a Fed rate cut drained liquidity from crypto markets.

Michael Saylor remains unwavering in his conviction that Bitcoin's scarcity will drive its value beyond gold by 2035. With 99% of all Bitcoin expected to be mined by then, the MicroStrategy executive calls this impending milestone the 'digital hardening' of the asset class.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical and sentiment analysis, BTCC financial analyst Sophia provides the following BTC price predictions:

| Year | Price Forecast (USDT) | Key Drivers |

|---|---|---|

| 2025 | $90,000 - $120,000 | ETF flows, institutional adoption, macroeconomic conditions |

| 2030 | $250,000 - $500,000 | Halving cycles, regulatory clarity, global adoption |

| 2035 | $800,000 - $1.5M | Store-of-value narrative, gold market cap competition |

| 2040 | $2M+ | Scarcity, decentralized finance dominance |

These projections assume continued adoption and no catastrophic regulatory actions. Short-term volatility may persist due to liquidations and sentiment shifts.